carried interest tax uk

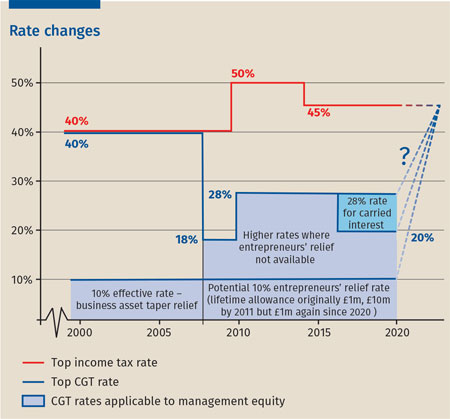

Tax rate on the carried interest just 28. The debate focused on the issue of whether carried interest should be taxed as an investment or as remuneration for services.

The Carried Interest Debate Is Mostly Overblown Tax Foundation

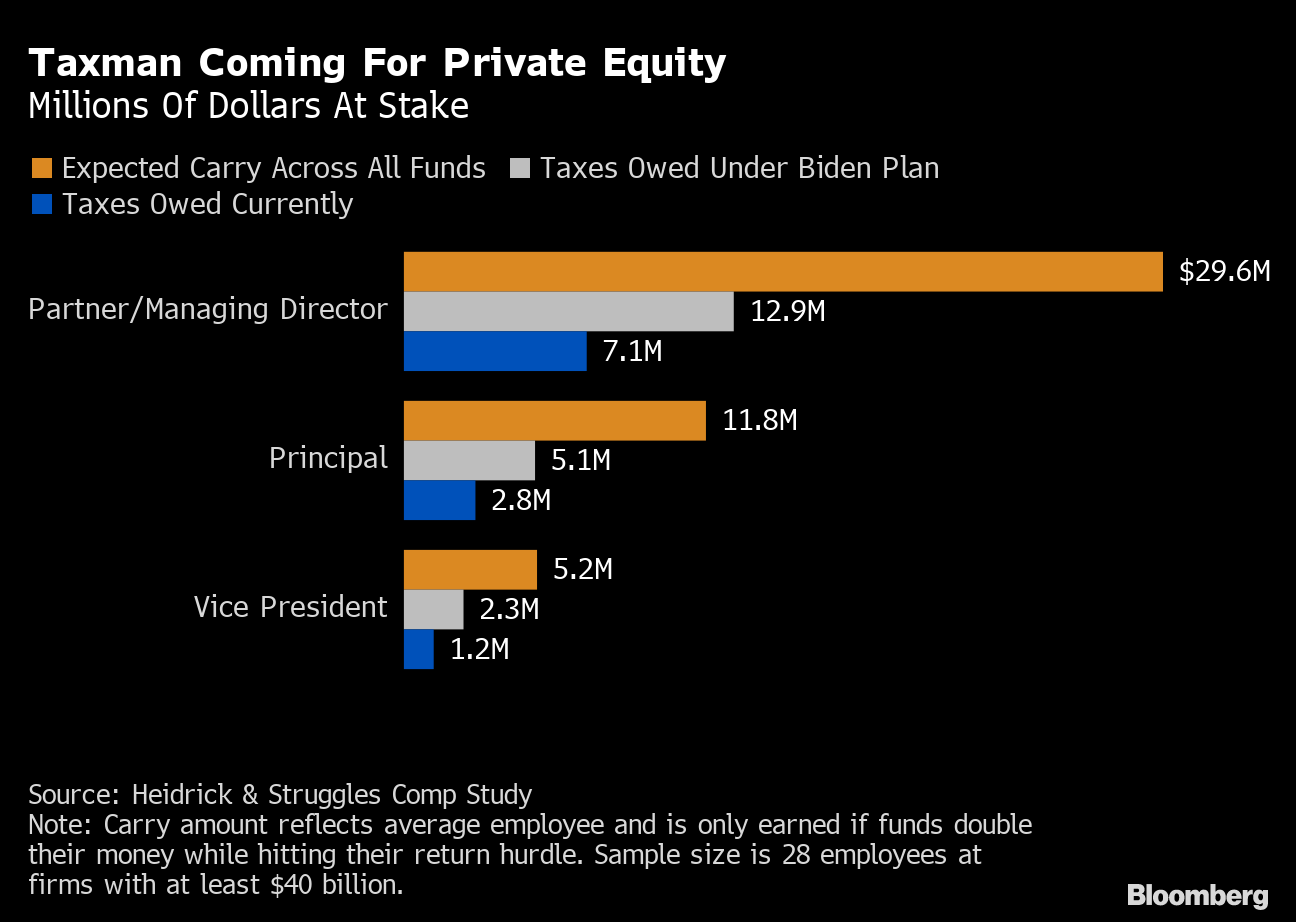

Many commentators argue that it would be fairer and more efficient economically to tax carried interest like wage and salary income which is subject to a top rate of 37 percent.

. Legislation will be introduced in Finance Bill 2017-18 to confirm that the carried interest provisions in sections 103KA to 103KH TCGA 1992 will apply to all carried interest. Although it is true that carried interest gains are taxed at 28 this is a special higher rate than would be paid on other gains on share sales taxed at a maximum of 20. You may also get up to 5000 of interest and not have to pay tax on it.

Firstly where an individual performs investment management services directly or indirectly in respect of an investment. This is your starting rate for savings. 5 rows Dry tax.

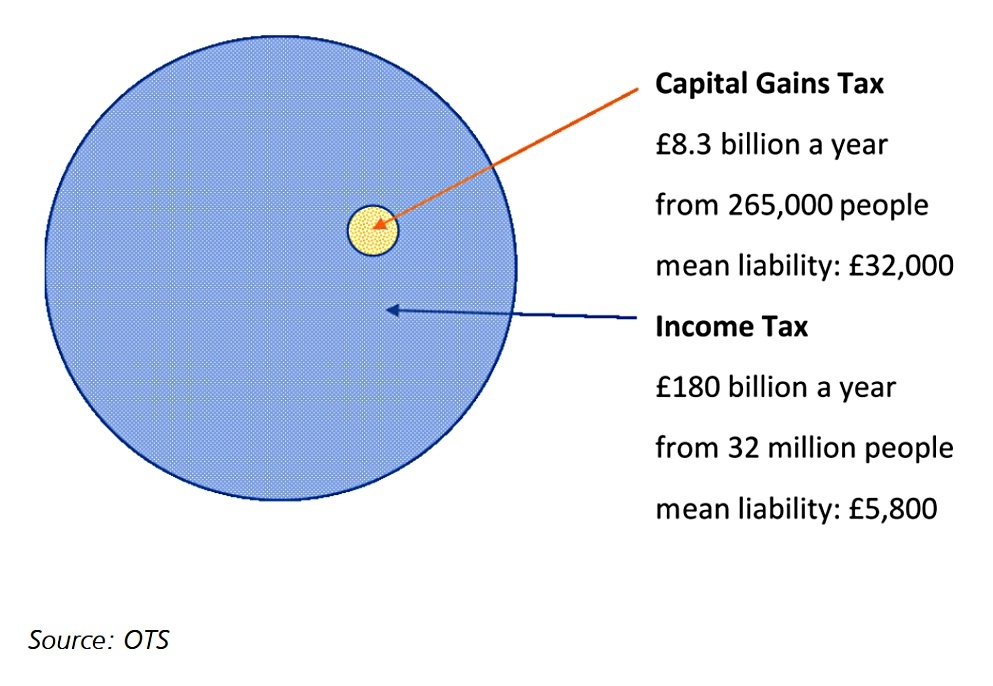

A capital gains charge under the carried interest rules will therefore be levied on the fund manager. UK National Security Laws Summer update. However the rate of CGT applicable to carried interest remains at 28 whereas a rate of 20 applies to most other types of capital gain.

The more you earn from other income for example your wages or pension the. The company pays corporation tax on the carried interest amount. It is now post-summer and back to school in the UK but not without recent developments under the UK National Security and.

From 6 April 2016 amounts of carried interest that arise from funds which do not hold their assets for 40 months or more can be classed as income based carried interest and will be charged to. The legislation applies in two sets of circumstances. Again UK resident doms and non-doms.

Carried interest has increasingly come within HM Revenue Customs focus due to the potential risk of ordinary management fees being disguised as carried interest to avoid. If carry were treated as remuneration then it would. This tax information and impact note deals with changes to the carried interest rules for Capital Gains Tax announced at Autumn Budget 2017.

However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment. This measure will make the tax system fairer by ensuring that individuals to whom a gain arises in the form of carried interest are taxed on their true economic gain. A key exemption from these rules is the carried interest exemption which if met means that amounts should be subject to capital gains tax at a lower rate of 28.

28 capital return 453935 income return 238 long. And that planning tools. Income Based Carried Interest IBCI which is subject to income tax and NIC and carried interest which is not IBCI which.

New clauses are inserted by Finance Act 2016 which aim to beef up the tax charged and ensure that investment. The holders of carried interest do not start to share in returns until investors have received broadly an amount equal to their original investment plus an additional return preferred. Carried interest now falls into one of two categories.

Under the IBCI Rules carried interest which is income-based carried interest will be taxed as trading income under the DIMF Rules at 47 per cent.

This Tax Loophole Costs 180bn A Decade Why Won T Democrats Close It Robert Reich The Guardian

Eversheds Watch List For The Autumn Statement Publications Eversheds Sutherland

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Cgt Rate Changes What S Ahead For Private Equity Managers

Will The Prospect Of A 51 Per Cent Tax Lead To An Exodus Of Us Private Equity Money Rsm Uk

How A Carried Interest Tax Could Raise 180 Billion The New York Times

Kyrsten Sinema Took Wall Street Money While Killing Tax On Investors In Democrats 740billion Bill Daily Mail Online

Carried Interest Loophole Survives The Inflation Reduction Act

What Carried Interest Is And How It Benefits High Income Taxpayers

Proposal On Hong Kong S Carried Interest Tax Concession Regime Lexology

How Should Carried Interest Be Treated By The Tax Code

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole Bloomberg

Carried Interest In Private Equity Calculations Top Examples Accounting

Will The Uk Axe Private Equity Tax Break Worth Millions Financial Times

Capital Gains Tax Review 7 Circles

:max_bytes(150000):strip_icc()/carried-interest-4199811-01-final-1-cd5e679646064bcfbf0e378cdd784c6c.png)

Carried Interest Explained Who It Benefits And How It Works